Long Term Macro Trends & Current Market Conditions in US Commercial Real Estate

US CRE is estimated to be a $20.7 trillion market, Institutional investors have been steadily increasing their allocation to real estate, as high as 13% of total portfolio. Same trend for individual investors: According to CNBC, 75% of high-net-worth investors between the age of 21-42 with at least $3M to invest expect above average returns and are increasing allocations to real estate. Cash flowing assets offer tax efficient wealth creation in a strong currency like $USD

Opportunities in US Commercial Real Estate

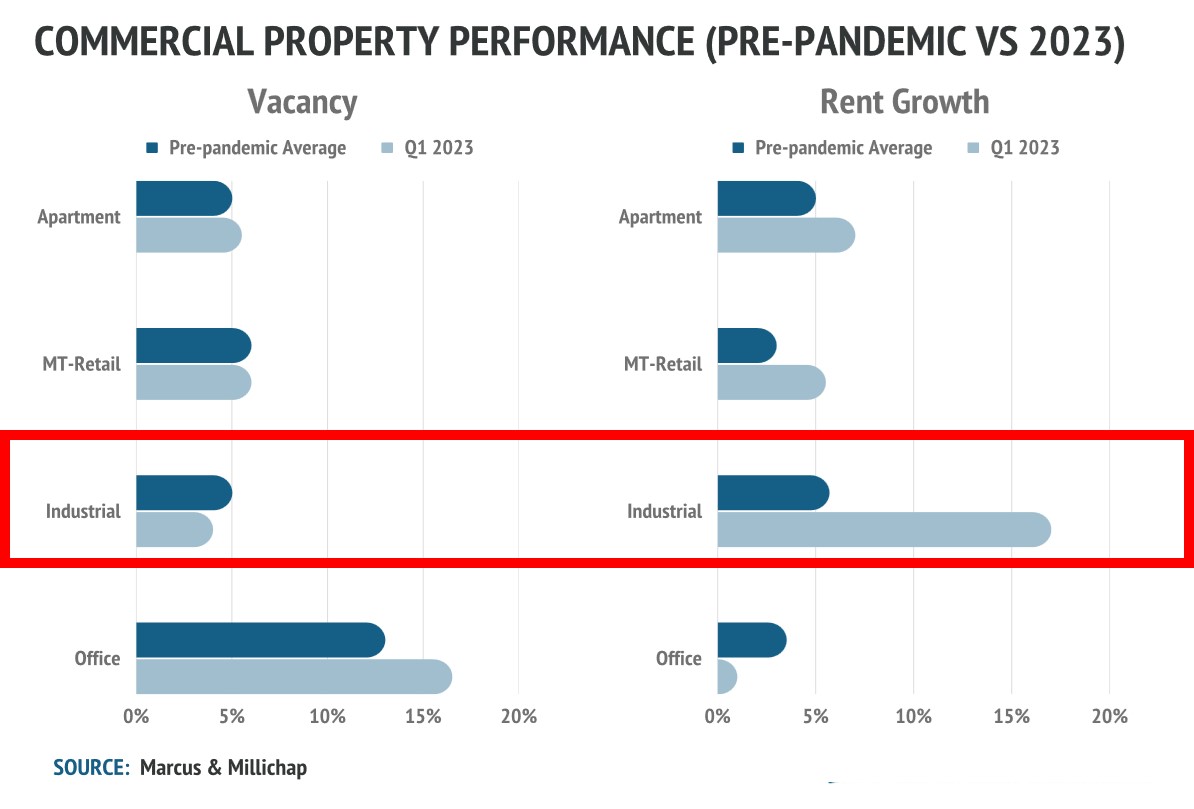

2023 indicates a year of unprecedented opportunity due to a confluence of several factors: Recession, rising interest rates, tightening credit markets, declining NOI margins, inflation affecting consumer confidence and lowering disposable income levels.Price correction, especially available to cash buyers. Tighter lending and high interest cost combined with higher exit interest rate underwriting will affect all assets including multifamily and industrial, but fundamentals are very strong, both financially and demographically.

COMMERCIAL REAL ESTATE PRIVATE DEBT OPPORTUNITY – White Paper

Commercial real estate private debt / capital is an emerging, viable and scalable investment strategy that may deliver superior risk adjusted returns to investors in the midterm. This paper introduces the concept of private debt and summarizes current market conditions in the US shaping this strategy with a focus on commercial real estate investment opportunities.

MULTIFAMILY SECTOR OPPORTUNITY – White Paper

The multifamily rental segment that constitutes approximately 70% of the $5.4 trillion overall commercial real estate market in the US is an established, resilient, and viable investment strategy that has delivered superior risk adjusted returns to investors in the past and may continue to do so for the foreseeable future

INDUSTRIAL SECTOR OPPORTUNITY – White Paper

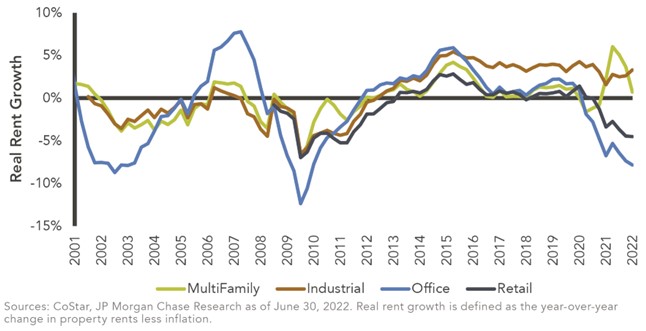

The industrial real estate segment, spanning approximately 22 billion square feet, is one of the largest asset classes of the commercial real estate market in the US and thus is a sought after, viable investment opportunity that has delivered superior risk adjusted returns to investors in the past several years.